Commercial Solar Battery Rebates in Australia: A Complete Guide for Businesses

Businesses across Australia are increasingly turning to solar battery storage to reduce energy costs, improve reliability, and make better use of the solar power they generate. While batteries can require a significant upfront investment, a range of federal and state-based rebates and incentives can make commercial battery systems far more affordable.

This guide focuses exclusively on commercial opportunities, providing a clear and up-to-date overview of the rebates and incentives available to Australian businesses looking to invest in solar batteries.

Key Takeaways:

Lower upfront battery costs: Commercial solar battery rebates can reduce installation costs by around 30% through the federal Cheaper Home Batteries Program, with additional savings available from state-based incentives.

Stack rebates for bigger savings: Businesses can combine federal solar and battery rebates to significantly cut total system costs, shorten payback periods, and maximise long-term electricity bill savings.

Act early to lock in higher rebates: Rebate values will step down every six months from May 2026, so installing sooner can secure higher incentives and improve overall return on investment.

Eligibility varies by system and location: Battery size, usable capacity, property type, and state-based rules all affect eligibility, making correct system design and accredited installers essential.

Contents

Here's what we'll cover in this article:

Federal Incentive for Commercial Solar Batteries

In July 2025, the Australian Government introduced the Cheaper Home Batteries Program to make battery storage more accessible for households, small businesses, and large commercial sites. The program aims to reduce the upfront cost of installing a solar battery by around 30%, helping businesses store excess solar energy and reduce reliance on the grid.

Under the program, battery systems with a capacity between 5 kWh and 100 kWh are eligible for a rebate. The rebate applies to the first 50 kWh of usable storage and is calculated based on how much usable energy the battery can deliver, rather than its total (nominal) capacity. Like the federal solar rebate, the battery rebate is designed to gradually decrease over time, with scheduled step-downs continuing through to 2030.

Due to strong demand, the government announced further updates in December 2025. Total funding was expanded to $7.2 billion through to 2030, ensuring the program remains available and is not exhausted early. However, from May 2026, rebate values will begin to step down every six months, rather than annually. A new tiered rebate structure will also be introduced, meaning larger battery systems will receive a lower rebate per kilowatt-hour than smaller systems.

STC rates by battery size

Up to 14 kWh: Full rebate applies

14–28 kWh: Reduced rebate applies

28–50 kWh: Minimal rebate applies

Here's what your solar rebate will look like in 2026 onwards:

| Year Installed | Period | STC Factor | Approx. Value Per kWh |

|---|---|---|---|

| 2026 | January - April | 8.4 | $336 |

| 2026 | May - December | 6.8 | $272 |

| 2027 | January - June | 5.7 | $228 |

| 2027 | July - December | 5.2 | $208 |

| 2028 | January - June | 4.6 | $184 |

| 2028 | July - December | 4.1 | $164 |

| 2029 | January - June | 3.6 | $144 |

| 2029 | July - December | 3.1 | $124 |

| 2030 | January - June | 2.6 | $104 |

| 2030 | July - December | 2.1 | $84 |

Battery Rebate Eligibility Criteria for Businesses

To qualify for the federal battery rebate, businesses must meet several key requirements:

The battery must have a total capacity between 5 kWh and 100 kWh. The rebate amount is based on the battery’s usable capacity, not the total capacity

STCs can only be claimed on the first 50 kWh of usable battery capacity

The battery must be VPP capable

The battery must be installed with a new or existing solar PV system by a Clean Energy Council (CEC) accredited installer and must meet state electricity and safety standards

How To Apply For the Commercial Battery Rebate?

To access the upfront discount, businesses must apply for the rebate. The good news? If you work with a trusted and experienced solar installer, most of the process is handled for you. Here’s what you should do:

Check your eligibility. If you're unsure, you can always chat with a reputable battery installer obligation-free. They can advise whether your business qualifies and estimate how much you could save.

Choose an accredited installer: Work with a program-approved installer. They manage the rebate application, so your business doesn’t need to submit paperwork separately.

Installation and rebate: Once your installer completes the battery installation, the rebate is claimed automatically and applied before you pay, reducing your initial investment and helping your business save on energy costs faster.

If your business is considering a battery, it’s best to start the process as soon as possible. High demand means installation schedules are filling up fast, Delaying could reduce the rebate your business is eligible for.

Stacking Federal Solar and Battery Rebates to Maximise Business Savings

One of the biggest advantages for businesses investing in renewable energy is the ability to combine the federal solar rebate with the federal battery rebate, significantly reducing upfront costs.

Using both rebates delivers value in two ways. Solar helps lower electricity bills during the day by generating power on-site, while a battery stores unused solar energy for use during peak pricing periods, after hours, or during power outages. When stacked together, these rebates can reduce the total cost of a system by tens of thousands of dollars, making larger solar and battery installations much more affordable than installing either technology on its own.

For many businesses, the greatest savings come down to timing and system design. Installing solar and a battery together, or adding a battery to an existing solar system, helps ensure eligibility for both rebates and allows businesses to secure higher rebate values before scheduled reductions. As rebate amounts decrease over time, acting earlier can significantly improve overall return on investment.

State Incentives for Businesses

In addition to federal rebates, several states and territories offer commercial battery incentives that can be stacked with federal programs to further reduce costs.

ACT: Sustainable Business Program

The ACT offers grants of up to $13,000 for energy efficiency upgrades, including solar batteries. The program is designed for small and medium businesses and can be combined with solar PV systems or other energy-saving measures.

NSW: Virtual Power Plant (VPP) Incentives

In New South Wales, businesses may access incentives by connecting their batteries to an approved Virtual Power Plant (VPP). These programs require batteries to export energy back to the grid and can provide ongoing revenue, in addition to any upfront benefits.

NT: Solar for Multi-Dwellings Grant Scheme

The Northern Territory offers support for multi-unit and commercial strata buildings, covering shared solar and battery installations used by multiple tenants. This scheme is well suited to accommodation providers, mixed-use developments, and commercial multi-dwelling properties.

WA: Residential Battery Scheme

Western Australia’s battery scheme is primarily residential, but some small businesses operating in residential-style or mixed-use properties may be eligible. Additional incentives may apply for VPP participation, with eligibility assessed based on metering arrangements and property classification.

Example: How Rebates and Batteries Can Save Your Business Money

To see the impact of combining solar and battery rebates, let’s look at a typical commercial scenario.

Scenario: A medium-sized warehouse installs a 100 kW solar PV system with a 50 kWh solar battery. By leveraging both the federal solar rebate and the federal battery rebate, the business can significantly reduce upfront costs.

Financial Impact:

Federal solar rebate: Reduces the solar system cost by around $27,000.

Federal battery rebate: Cuts the battery installation cost by around 30%, saving around $14,000 (until April 2026)

Energy savings: The business uses stored solar energy during peak electricity pricing, reducing monthly electricity bills by several thousand dollars.

Payback period: Combining rebates and operational savings can reduce the payback period by 2–4 years, depending on electricity usage and system size.

Key takeaway: By planning installations strategically and stacking rebates, businesses can install larger solar and battery systems at a much lower upfront cost while maximising long-term energy savings and operational resilience.

Conclusion

Commercial solar battery rebates can significantly reduce upfront costs and improve the long-term return on investment for businesses. However, maximising these benefits requires a clear understanding of eligibility rules, rebate step-downs, and stacking opportunities.

By strategically combining federal and state incentives, businesses can invest in battery storage that lowers energy costs, improves resilience, and helps future-proof their operations against rising electricity prices.

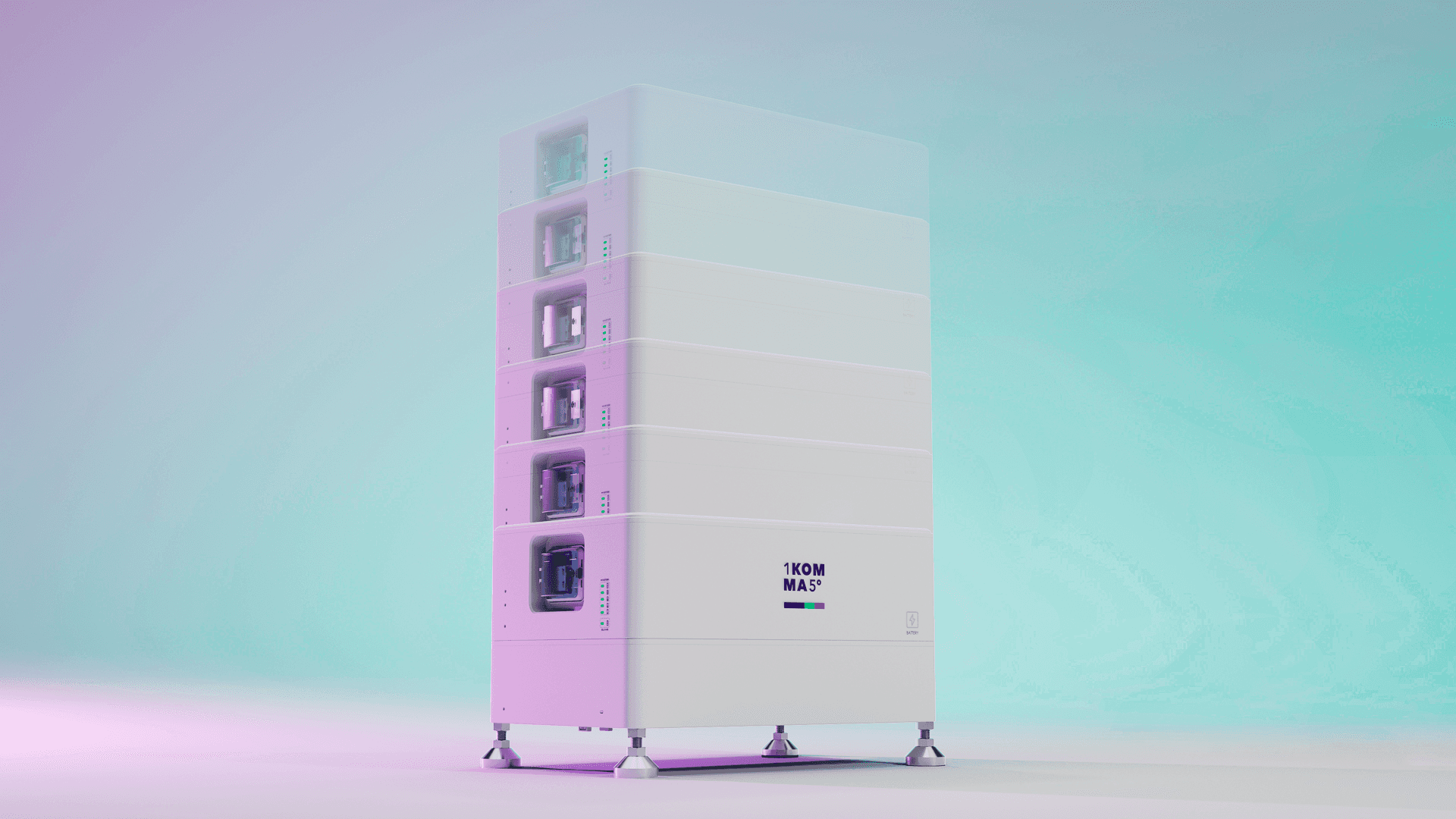

If you’re interested in installing a battery storage for your business, speak to the 1KOMMA5° team. They can help talk you through the available rebates, the wider installation process and other important details.

Frequently Asked Questions about Installing Solar Power

Are there any rebates available?

There are great government rebates/incentives still in place for eligible households. Basically, the larger the panel array, the more STCs your solar system generates as it is based on the expected output of the system over time.

When you buy a solar system, the purchase price is normally reduced by the value of the STCs created by your system. You simply fill out a form on the day of installation to confirm that the system has been installed, and that’s it. There is no additional paperwork that you need to do.

Small-scale Technology Certificates (STCs)

Small-scale Technology Certificates (STC’s) – previously known as Renewable Energy Certificates or RECS – are created when a Renewable Energy System such as a Solar PV system is installed.

The number of STC’s depends on the predicted amount of energy generated and hence the larger the system the greater the rebate. In essence, one STC is created for every megawatt-hour of production capacity of the system.

This is further multiplied by the number of years the system is likely to generate energy (for home solar systems, this is usually 15 years, although the life of the solar panels themselves is considerably more than that).

This incentive program is being phased out until 2030, so each year the number of certificates your system is eligible for reduces.

STC Price

The system for trading and pricing STCs for small systems is managed by the Small-scale Renewable Energy Scheme (SRES).

STCs are bought by Liable Parties (usually electricity retailers) and must be surrendered at the end of each quarter. As the number of STCs that are required to be surrendered is a fixed amount each year, but the number of STCs created is variable, the price paid for STCs also varies and is determined by supply and demand.

The Federal Government legislated in 2010 a fixed price for STCs by implementing a Clearing House system where STCs can be bought and sold for $40. However, there is no requirement for Liable Parties to purchase from the Clearing House, so they are likely to only do so if there is a shortage of STCs or the market price exceeds $40. There is currently a surplus of STCs in the market which means the market price of STC’s below $40

How does the feed-in tariff work?

The Feed In Tariff is only something you need to worry about if you don’t have battery storage.

The price your chosen energy retailer pays for any excess electricity generated from your solar panels is recorded as a credit on your power bill.

In NSW, solar power is fed into your home as it is generated and your household will use it first before you draw power from the grid.

This means that for every kWh of solar power used in the home you are directly saving money you’d spend on your power bill. This reduction in your power bill is the main financial benefit of solar power.

Everything else will be bought up at an agreed rate by your electricity retailer.

At the moment, most feed-in tariffs are between 5 and 10 cents per kWh, with many being about 7 cents. They bounce up and down a lot, for example in previous years they have been up over 20 cents per kWh. Typically, they are always at least 5 cents per kWh.

What happens once I sign the paperwork?

Once you sign up for a 1KOMMA5° Installation, we immediately submit your grid application to the relevant energy distributor. For systems up to 5kWs, this is a formality. For larger systems it can take a few days or more. Once we receive approval, your installation will be managed by our installation coordinator, who will welcome you to 1KOMMA5° and book an installation date for you. This is generally booked within around two weeks and installation dates are available Monday to Friday, weather permitting.

We endeavour to have your system installed within 2-4 weeks unless you request us to hold for whatever reason. Due to our strict safety policy, we do not install solar systems when it rains. In the event of inclement weather, we will rebook your installation as soon as possible. We always work with your requests as we strongly recommend that someone be home on the day of installation.

Do you offer finance?

Green Loans can be an affordable way to pay for your solar power system and is only available for approved products. As a Clean Energy Council Accredited installer, all our systems qualify.

Green Loans can be used to finance 1KOMMA5° systems from $1,000 to $30,000 over a 2-7 year term. Once you have received a referral from 1KOMMA5°, online approval usually occurs within 1-2 business days. Green Loans have a competitive fixed interest rate that is as low as 7.99% p.a.* | Comparison rate 9.21% p.a.^ Establishment fee of $299 added to the loan amount. $2.70 per week account keeping fee included in repayments.

To be eligible to apply you must:

Be over 18 years old and an Australian resident or citizen

Own or be purchasing a home

Be employed, self-employed, a self-funded retiree; or is receiving the Government Age Pension

Have an Australian driver’s license or Passport

Provide two most recent payslips or 90 days of bank statements

There are a number of good, competitive Green Loan providers – ask us about the options available.

More Helpful Articles:

Financial Planning for Solar – What Else to Consider

1KOMMA5° Blog

Need more information?

Head over to the 1KOMMA5° blog for more helpful tips and other important guides on everything solar, from inverters, panels and batteries to how to make the most of your investment for years to come.